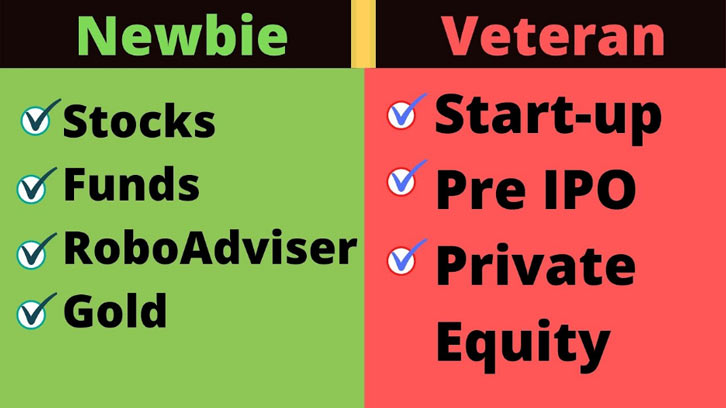

Investing in private companies can be a great way to generate income and gain access to unique, high-growth opportunities. But it’s not for the faint of heart; investing in a private company significantly differs from investing in publicly traded stocks or mutual funds. Knowing what you’re getting into – from regulations and tax considerations, legal structures, and ownership rights to negotiating terms with owners – is essential before taking the plunge.

In this blog post, we’ll walk you through how to approach investing in private companies responsibly and strategically so that you can make smart investments that offer big returns.

Understand the basics of investing in private companies:

Investing in private companies can be a great way to access unique, high-growth opportunities. However, it’s important to understand the basics before taking the plunge. There are certain regulations and tax considerations you need to keep in mind, as well as legal structures and ownership rights that may apply.

When investing in a private company, you should thoroughly research its history and management team. Look into how they’ve handled past investments and what kind of returns they’ve achieved. Additionally, familiarize yourself with financing options, such as venture capital firms or angel investors, so you understand which would best suit your investment needs.

You should also become familiar with common private investment documents, such as shareholder agreements and term sheets. You’ll need to negotiate the terms of your investment with the company owners, so it’s important to know what you’re getting into before doing so.

Finally, make sure that you’ve adequately diversified your portfolio. Investing in a single private company carries more risk than investing in publicly traded stocks or mutual funds – which makes it important to ensure that you have a diverse set of investments across different sectors and industries.

Research and compare different types of funding options:

If you're looking to invest in a private company, it's important to research and compare different types of funding options. The type of financing you choose will determine the level of risk you take on as an investor.

One popular option is venture capital (VC) funding. VCs are typically high-net-worth individuals or organizations who offer capital investments in exchange for equity stakes in potentially profitable companies. While these investments can be risky, they also have the potential to generate significant returns if the company succeeds.

Angel investors are another common form of financing for private companies. Angel investors usually require less equity than VCs and may provide smaller amounts of capital upfront with a promise of additional funds down the line. This approach allows companies to take on less risk while still having the potential to grow.

In addition to VCs and angel investors, you may find private equity firms or investment banks willing to invest in your chosen company. These types of investments usually come with strict requirements and a timeline for repayment, but they can provide access to more capital than what would otherwise be available.

Finally, some companies may offer crowdfunding as an alternative form of financing. This involves raising small amounts of money from a large group in exchange for equity stakes in the business. While it can potentially bring in larger sums of money than other options, crowdfunding is often seen as more risky due to its lack of structure and oversight.

Consider the risks associated with investing in private companies:

Investing in private companies can be a great way to access unique, high-growth opportunities. However, it’s important to consider the risks of this type of investment before taking the plunge.

For one, there is typically more risk involved than when investing in publicly traded stocks or mutual funds. Private companies often lack effective oversight and transparency, so you must do your due diligence before investing to understand the potential risks and rewards. Additionally, since private company shares are not freely tradable on public exchanges, liquidity can be an issue if you decide to sell your investments.

In addition, private investments also expose investors to additional tax considerations they may have yet to be aware of before investing. In some cases, certain types of private investments can be subject to higher tax rates than other investments.

Furthermore, you may be locked into the investment for long periods as there is no guarantee that the company will ever become publicly traded and available on an exchange. When deciding, you should also consider potential risks associated with ownership rights, such as voting rights and board seats.

Analyze the financials of a potential investment before committing funds:

Before committing funds to a potential investment, analyzing the company's financials is important. This is essential for any investor looking to gain insight into their target company's performance, success, and stability.

First, investors should review the company's balance sheet to get an accurate understanding of its assets, liabilities, and shareholders' equity. The balance sheet will also provide information regarding any current or previous borrowings that could affect the business's cash flow and other financial aspects.

Next, investors should review income statement data such as revenue, gross profit margin, and operating expenses to assess profitability and overall performance. This will help investors understand how well a company manages its costs relative to its income. Additionally, investors can use income statement data to gain insight into a company’s financial position and the potential for future growth.

Finally, it is important to review the company's cash flow statement. This will provide insights into how much cash is being generated and used and any changes in balances that could affect future performance. By understanding these three key financial statements, investors can make more informed decisions concerning their investments.

FAQs

Q: What should I look for when considering investing in a private company?

A: Before investing in a private company, it is essential to understand the regulations and tax considerations, legal structures, and ownership rights involved with the investment. It’s also important to research the industry, market trends, performance of similar companies, management team credentials, investor history/track record, risk profile, and competitive landscape. Furthermore, investors should assess their financial situation to ensure they can handle any risks associated with the investment.

Q: How do I negotiate terms with owners when investing in a private company?

A: Negotiating terms for an investment into a private company requires thorough knowledge of securities law, taxation rules, and business operations. Investors should seek professional advice and be aware of their rights as an investor, such as the right to inspect documents, access financials, and receive a contract copy. Additionally, investors should review all agreements thoroughly to ensure they are comfortable with the terms and that all disclosures are accurate. Lastly, it is essential to understand any restrictions associated with the investment (such as voting rights or transferability). These steps allow investors to confidently negotiate terms when investing in private companies.

Q: What other considerations should I consider when investing in private companies?

A: There are additional factors to consider when investing in private companies. These include the impact of liquidity, dilution risk, and the potential for exit barriers. Investors should also know any regulatory requirements associated with their investment and consider how these could affect their returns. Lastly, investors need to assess their risk capacity and understand that private company investments carry greater risks than those associated with publicly traded securities or mutual funds.

Conclusion

Investing in private companies can greatly expand your portfolio and access unique, high-growth opportunities. However, it is important to understand the risks associated with these investments and legal considerations before taking the plunge. By researching the industry, assessing their financial situation, and negotiating terms effectively, investors can make informed decisions concerning investing in private companies responsibly and strategically.