What is the Recovery Rebate Credit, and how does it apply to your taxes? With income levels shifting due to the ongoing pandemic, many people find themselves seeking help in finding ways to maximize their tax returns.

To assist taxpayers, Congress passed legislation creating a refundable credit called the Recovery Rebate Credit (RRC) that can be claimed when filing 2020 federal income taxes. If you are still determining whether you qualify for this special credit or need help

To understand how it works, read on! This blog will provide an overview of key information regarding eligibility, amounts received under this program, and helpful guidance on preparing your taxes correctly. Keep reading to learn more about the RRC - because every bit of money-back helps now!

What Was the Recovery Rebate Credit

The Recovery Rebate Credit was a one-time payment to eligible individuals and families impacted by the coronavirus pandemic. The credit was designed to relieve those who may have lost income, had reduced hours, or experienced other financial hardships due to the pandemic.

Understanding the Recovery Rebate Credit

The Recovery Rebate Credit (RRC), also known as Economic Impact Payments or stimulus payments, is a refundable tax credit established as part of the CARES Act to offer economic relief payments.

This credit can be claimed on your 2020 and 2021 Form 1040 or 1040-SR if you have yet to receive one or more payments or the full amount due.

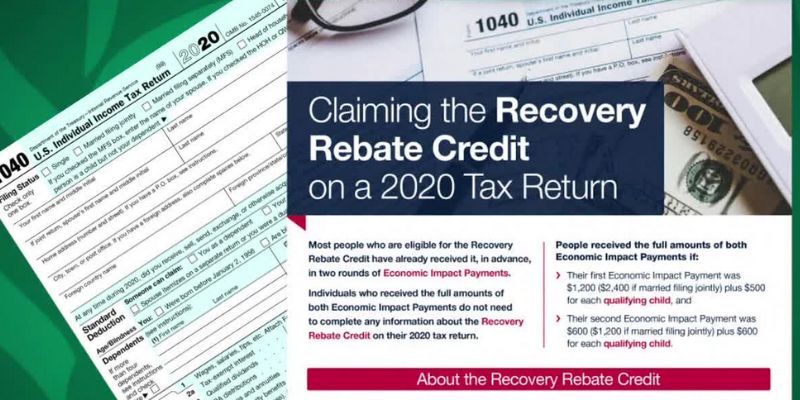

Initial RRC payments for eligible individuals were made in 2020 and early 2021, valued at $1,200 per adult plus $500 for each extra qualifying dependant under the age of 17. From March 2021 to December 2021, a third round of Economic Impact Payments—including plus-up payments—was made.

If you qualify for the Recovery Rebate Credit, it will either increase your tax refund amount or decrease the taxes you owe. Even if you don't owe any taxes, you will still receive a tax refund for the amount due to these stimulus payments.

To be eligible for this credit, your income must fall within certain thresholds based on filing status and number of qualifying children. Additionally, individuals claimed as dependent on another person's return, nonresident aliens, and certain filers are not eligible.

To claim the Recovery Rebate Credit, you must complete IRS Form 1040 or 1040-SR, including line 30a specifically designed for the RRC. When completing the form, accurately report your income and number of dependents. Additionally, you should correctly enter the payment amounts received for each round to avoid issues with claiming the credit.

It's important to know that if you already claimed the RRC on your 2020 tax return, you cannot claim it again on your 2021 tax return. Also, if you are still owed payment from either year, they will be sent out after filing taxes or change your banking information at IRS.gov/COVIDReliefUpdate.

By understanding how Recovery Rebate Credit works and how to qualify, taxpayers can maximize their returns and benefit from the economic relief payments provided by Congress through the CARES Act.

Qualifying for a Recovery Rebate Credit

To qualify for a Recovery Rebate Credit, taxpayers must first determine if they are eligible. Eligibility requirements include:

- Being a U.S. citizen or resident alien in 2020 and 2021

- Not being a dependent on another taxpayer for the tax years 2020 and 2021

- having a Social Security number issued before their 2020 or 2021 tax return (including extensions) is due.

If you meet these general eligibility criteria, then three scenarios could make you eligible for either a full or partial credit:

- You were eligible for payment but did not receive one.

- You should have received the full amount you were entitled to.

- Your 2020 or 2021 income made you eligible for a rebate.

- You had a child in 2020 or 2021 after you received your stimulus payment.

Amount of Credit

Depending on the taxpayer's qualifying and filing status, the Recovery Rebate Credit's value fluctuates. The standard deduction for single taxpayers is $1,200 ($2,400 if married filing jointly), with an additional $500 for each eligible dependent child under the age of 17.

Claiming the Rebate

When submitting Forms 1040 or 1040-SR for their 2020 federal income taxes, taxpayers must claim the Recovery Rebate Credit. The IRS has developed an interactive application called "Non-Filers: Enter Payment Info Here" to assist taxpayers who did not file a tax return in 2019 or 2020 but still wish to be eligible for the Recovery Rebate Credit. On the IRS website, you can find this tool.

Additionally, the credit might be given to taxpayers who are entitled to a refund when they file their taxes. You will not be able to claim the credit, however, if you do not owe any taxes after claiming it. Instead, you must use the "Get My Payment" application to request an Economic Impact Payment.

Can I still claim the Recovery Rebate Credit if I already filed my 2020 or 2021 Taxes

You can still claim the Recovery Rebate Credit even if you have already filed your taxes. To do this, you must file an amended return and include Form 1040 or 1040-SR when claiming the credit. You may also be required to submit additional documentation depending on your specific situation.

Additionally, the credit may be added if you are eligible for a refund as part of your original tax filing. However, if after claiming the credit, your return shows that no taxes are due, then you will not be able to claim it and should instead apply for an Economic Impact Payment using the "Get My Payment" application.

It's important to note that taxpayers should not claim the Recovery Rebate Credit if they have already received an Economic Impact Payment. Doing so can confuse and delay processing your tax filing.

If you are eligible for a larger credit than what was provided through the Economic Impact Payment, consult a qualified professional to determine the best course of action.

FAQs

Is recovery rebate credit the same as stimulus checks?

No. The Recovery Rebate Credit is a tax credit claimed on the 2020 or 2021 federal income tax return and can be used to reduce taxes owed or increase a refund amount. A stimulus check, also known as an Economic Impact Payment (EIP), is a direct payment from the government and does not have to be repaid.

Do I need to file taxes to get the recovery rebate credit?

You must file your 2020 or 2021 taxes to claim the Recovery Rebate Credit. You must complete IRS Form 1040 or 1040-SR and include line 30a specifically designed for this credit.

I received two payments. Do I still qualify for the recovery rebate credit?

You may qualify for a partial Recovery Rebate Credit if you received two payments but are still owed money according to the income thresholds and of qualifying dependents. You should consult a qualified professional to determine if claiming the credit is right for you.

Conclusion

As 2020 and 2021 have put so much financial stress on individuals and families, the Recovery Rebate Credit was a welcome financial relief to many. Understanding the basics of what the Recovery Rebate Credit is, is only one rest of the process of claiming it. Although you may think that if you filed your taxes in 2020 or 2021, there is still time to claim a rebate, this is not true! Knowing the qualifications and how to claim a Recovery Rebate Credit can help you receive money for yourself and your family. Get the money you are entitled to by understanding Recovery Rebate Credit to plan for an even more financially stable future.