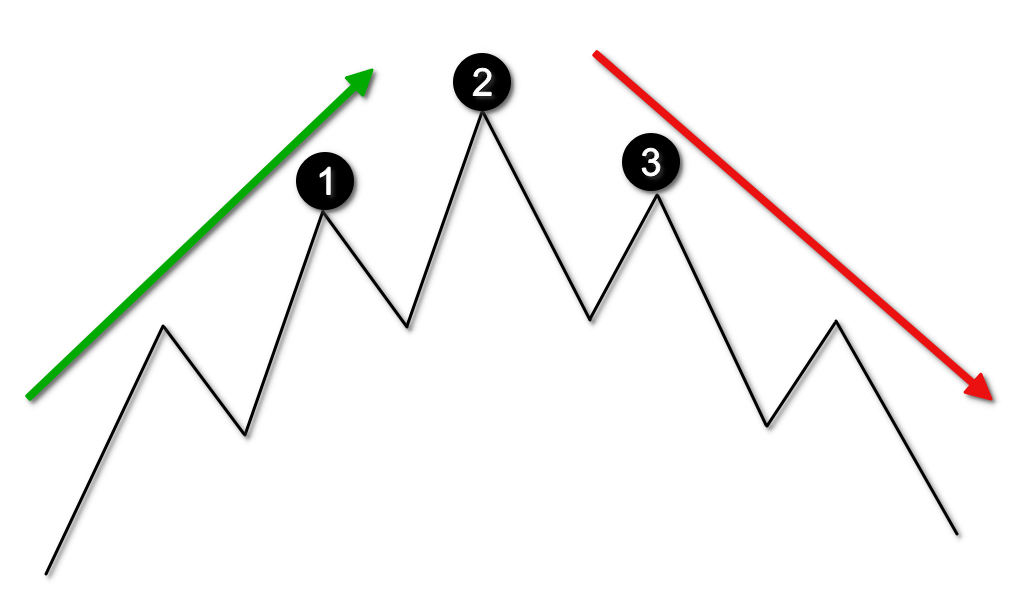

The head and shoulders pattern is a powerful tool in technical analysis that helps traders identify potential trend reversals in the financial markets. Comprised of three distinct peaks, namely the head and the shoulders, this pattern provides valuable insights into market sentiment and price dynamics. In this article, we will delve into the intricacies of the head and shoulders pattern, exploring its structure, identification techniques, and effective trading strategies.

What is the Head and Shoulders Pattern?

The head and shoulders pattern is characterized by its unique structure, consisting of three peaks and two troughs. We will examine each component in detail, discussing their roles and significance within the pattern. Additionally, we will explore the key characteristics that validate a head and shoulders pattern, ensuring its reliability in trading decisions. Moreover, we will introduce the inverted head and shoulders pattern as a variation of the classic formation.

How to Identify the Head and Shoulders Pattern?

Recognizing the head and shoulders pattern is crucial for successful trading. We will explore techniques and tools to identify this pattern on price charts. From fundamental visual analysis to more advanced technical indicators, traders will gain insights into the most effective methods of identifying head and shoulder formations. Additionally, we will discuss the importance of using multiple time frames to confirm the pattern and increase its reliability.

Recognizing the head and shoulders pattern is crucial for successful trading. We will explore techniques and tools to identify this pattern on price charts. From fundamental visual analysis to more advanced technical indicators, traders will gain insights into the most effective methods of identifying head and shoulder formations. Additionally, we will discuss the importance of using multiple time frames to confirm the pattern and increase its reliability.

Technical Analysis: Trading the Head and Shoulders Pattern

By combining technical analysis with Trading the Head and Shoulders Pattern strategies, traders can enhance their trading decisions and increase their chances of success.

Confirmation of the Head and Shoulders Pattern:

Before diving into specific trading strategies, it is crucial to confirm the presence of the Head and Shoulders pattern. Traders should ensure that the pattern meets the following criteria:

Structure and Formation

The pattern should consist of three distinct peaks or valleys: a left shoulder, a head, and a right shoulder. The head should be the highest peak (or lowest valley) in the pattern, with the shoulders lower (or higher) than the head. Additionally, the pattern should be preceded by an uptrend (for a bearish pattern) or a downtrend (for a bullish pattern).

Neckline Breakout

Confirmation of the pattern occurs when the price breaks below the neckline (in a bearish pattern) or above the neckline (in a bullish pattern). This breakout validates the pattern and signals a potential trend reversal.

Trading Strategies for the Head and Shoulders Pattern

Once the Head and Shoulders pattern is confirmed, traders can consider the following trading strategies:

Neckline Breakout Strategy

One of the most common strategies is to enter a trade after the neckline breakout. In a bearish pattern, traders can initiate a short position when the price breaks below the neckline. Conversely, in a bullish pattern, traders can enter a long position when the price breaks above the neckline. Stop-loss orders can be placed above the right shoulder's high (for a bearish pattern) or below the right shoulder's low (for a bullish pattern). Take-profit targets can be set by measuring the pattern's height and projecting it toward the breakout.

Pullback Strategy

Another strategy is to wait for a pullback to the neckline after the breakout. In this approach, traders enter the trade when the price retraces to the neckline, treating it as a support (for a bearish pattern) or resistance (for a bullish pattern) level. This strategy allows one to enter the trade at a better price, improving the risk-reward ratio. Stop-loss orders can be placed below the recent swing low (for a bearish pattern), or above the recent swing high (for a bullish pattern), and take-profit targets can be set using various techniques, such as Fibonacci extensions or prior support/resistance levels.

Retest Strategy

The retest strategy involves waiting for a retest of the broken neckline before entering the trade. After the initial breakout, the price may retest the neckline to verify its newfound role as a support (for a bearish pattern) or resistance (for a bullish pattern) level. Traders can enter the trade on the retest, provided there are no signs of a failed retest or reversal. Stop-loss orders and take-profit targets can be set using similar techniques as mentioned in the previous strategies.

Volume Confirmation

Volume plays a crucial role in confirming the Head and Shoulder pattern. Traders should observe the volume during the formation of the pattern. Ideally, the volume should be higher during the formation of the left shoulder and the head, followed by a decrease during the formation of the right shoulder. This volume pattern adds weight to the validity of the pattern and enhances the trading signals.

Timeframe Analysis

To improve the accuracy of trading the Head and Shoulders pattern, traders can analyze the pattern on multiple timeframes. Higher timeframe analysis can provide a broader perspective on the pattern's significance and increase the probability of successful trades.

Risk Management and Trade Execution

Regardless of the trading strategy employed, proper risk management is crucial. Traders should determine risk tolerance and set appropriate stop-loss orders to limit potential losses. Additionally, trade execution should be based on clear entry and exit criteria, allowing traders to enter and exit the market efficiently.

Conclusion

Trading the head and shoulders pattern requires knowledge, experience, and disciplined execution. By mastering the structure, identification techniques, and trading strategies associated with this pattern, traders can increase their chances of capturing profitable trades. The head and shoulders pattern offers a reliable framework for identifying potential trend reversals and can be applied across different financial markets. However, traders must remain vigilant, continuously learn, adapt strategies, and practice effective risk management. With dedication and perseverance, traders can harness the power of the head and shoulders pattern to achieve their trading goals and enhance their overall trading success.